66% of Ethereum Addresses Still Profitable Despite Market Downturn

- Ethereum sees only 66% of addresses in profit, reflecting a significant impact from the recent market downturn.

- ETH leads with a $155 million inflow, highlighting strong institutional interest despite market volatility.

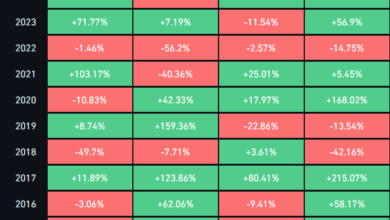

The latest market drop has put Ethereum (ETH) holders in a perilous situation, with only 66% of Ethereum addresses currently profitable, according to IntoTheBlock data. This large loss is comparable to what occurred in October 2023, when Ethereum was trading at roughly $1,800.

The collapse has served as a sharp reminder of the crypto market’s instability, sending many holders into the red as the value of Ethereum fell.

Just 66% of Ethereum addresses are currently in profit.

Last week's market downturn significantly impacted Ethereum, pushing many holders into the red.

The last time we saw a similar percentage of profitable holders was in October 2023, when Ethereum was trading around $1,800. pic.twitter.com/XhMonaaSPA

— IntoTheBlock (@intotheblock) August 12, 2024

Ethereum ETFs Surge in Trading Volume, But Face Early Net Outflows Amid Market Volatility

Despite the overall gloomy sentiment, Ethereum-based Exchange Traded Funds (ETFs) made a strong start, with trading volume reaching $5.8 billion. However, the jubilation was short-lived, as these ETFs experienced a net outflow of $484 million within their first week.

This disparity in performance shows the complicated dynamics at work in the cryptocurrency markets, where investor euphoria can swiftly fade in the face of broader market trends.

Beside that, as we previously reported, Ethereum has been leading the charge in terms of institutional interest, with a $155 million inflow, the most this year. The introduction of U.S.-based spot ETFs, which have sparked a lot of interest in the investment community, was largely responsible for this spike.

Franklin Templeton’s decision to build a tokenization fund on Ethereum emphasizes the growing merger of traditional finance and decentralized finance (DeFi), indicating a stronger commitment to blockchain technology from established financial organizations.

In addition to these improvements, Vitalik Buterin, Ethereum’s co-founder, has released important updates on the blockchain’s structure in a post on X. He stressed the necessity of having different players contribute transactions to a single block, which reinforces Ethereum’s decentralized character.

Furthermore, Buterin mentioned continuing discussions regarding perhaps eliminating the “last-mover advantage” in transaction sequencing, which might have serious consequences for how transactions are processed on the network.

Ethereum continues to be at the vanguard of innovation in the crypto industry, despite the hurdles given by market swings. At the time of writing, the ETH price is about $2,720.18, up 1.89% over the last 24 hours, with a daily trading volume of $15.08 billion.