Chainlink Launches Digital Assets Sandbox to Revolutionize Capital Markets

- Chainlink introduced the Digital Assets Sandbox (DAS), a new solution designed to help financial institutions conduct secure and efficient tokenization trials.

- The DAS also supports experimentation with various real-world digital asset use cases across different financial instruments.

On Thursday, July 18, oracle service provider Chainlink unveiled a new solution for institutions willing to conduct tokenization trials in the market. Chainlink launched the Digital Assets Sandbox (DAS) offering financial institutions a secure and efficient way to explore and build cutting-edge digital assets solutions.

As a result, DAS will allow financial institutions to quickly implement and launch new products like bond tokenization, transforming traditional bonds into tokens, thereby improving the time-to-market along with greater overall efficiency. As per the Crypto News Flash report, Chainlink has already been partnering with players like Instruxi to boost digital asset tokenization.

We’re excited to launch the #Chainlink Digital Assets Sandbox—a turnkey solution for accelerating innovation in capital markets.

This new sandbox enables financial institutions to conduct tokenization trials and collaborative PoCs within days, not months.https://t.co/SrXA6KLekK

— Chainlink (@chainlink) July 18, 2024

Angela Walker, the global head of banking and capital markets at Chainlink Labs, said that the launch of the new sandbox comes amid growing institutional demand for conducting digital asset experiments in a secure environment. Waler said:

The Chainlink Digital Asset Sandbox addresses this need by enabling institutions to create rapid Proof of Concepts in days, not months, and leverage Chainlink Labs’ experience in research and development to bring these use cases to life.

Additionally, the DAS facilitates experimentation with diverse real-world digital asset use cases across various financial instruments throughout their entire life cycles. This flexibility enables institutions to gain valuable insights and develop customized solutions to meet their specific needs and requirements.

Chainlink Sandbox to Boost Institutional Adoption of Blockchain

Big market players are willing to create more blockchain innovation and use cases, however, they need a safe testing environment for the same. Citing this market gap, Chainlink decided to create this Sandbox. Walker said:

The institutional world needs access to the blockchain industry, and Chainlink is the safe and secure standard that has the capabilities to facilitate onchain finance at scale, improving financial industry infrastructure.

The sandbox also provides institutions with ready-to-use digital asset workflows beyond tokenized bonds, including the opportunity to experiment with real-world asset (RWA) tokenization. This capability will further aid institutions in developing stronger business and investment cases for their digital asset strategies.

Management consulting giant BCG recently stated that the tokenization market could reach a value of $16 trillion by 2030. According to a 2023 report by Citigroup, analysts also conservatively estimate that an additional $4 trillion to $5 trillion worth of tokenized digital securities will be minted by the year 2030. Along with Chainlink, players like IOTA are also exploring big opportunities in the tokenization market, reported CNF.

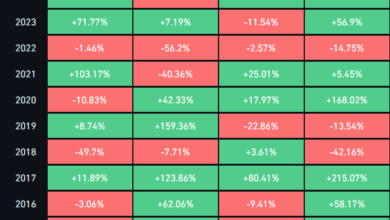

Chainlink’s native cryptocurrency LINK is currently trading 1.52% down at $13.57 with a market cap of $8.250 billion. The LINK price is trading at 10% gains on the weekly chart amid major accumulation per the CNF report.